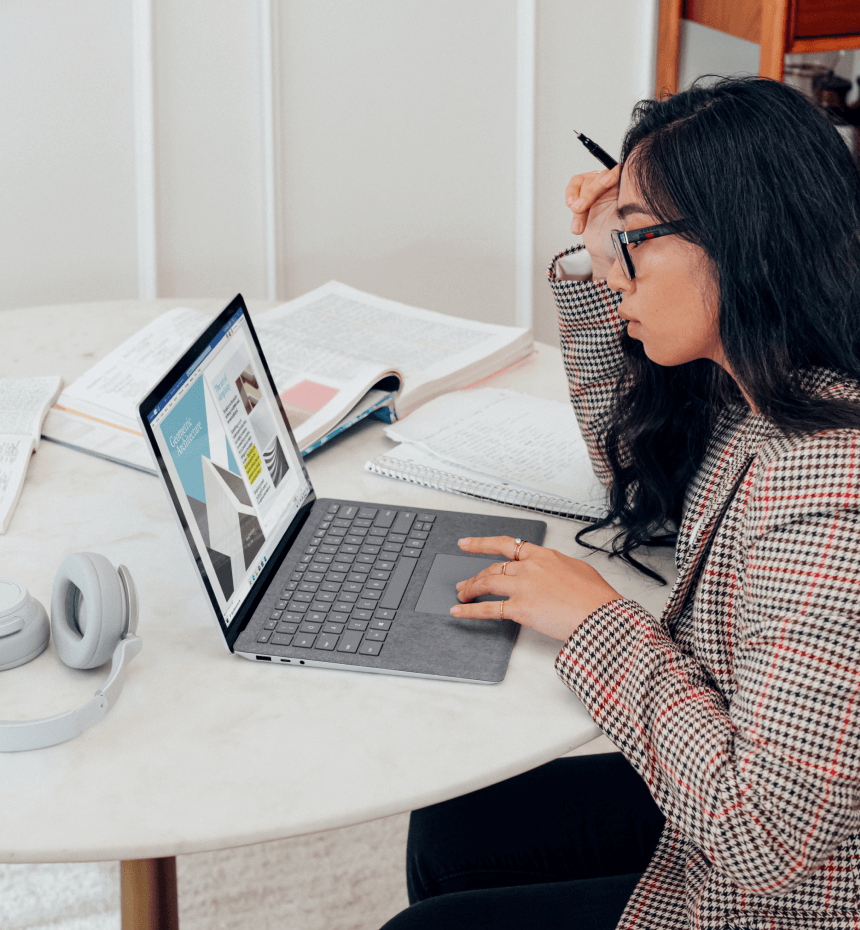

We Make International Business Loans Easy for Small Businesses

Get fast, flexible international business loans with no hidden fees. Apply online from anywhere and receive funds directly in your account.

Get fast, flexible international business loans with no hidden fees. Apply online from anywhere and receive funds directly in your account.

JP Lending Ltd is a trusted partner in international business funding, specializing in global commercial lending and cross-border financing. We help entrepreneurs secure the right international business loans to launch, grow, or expand operations. From international startup loans to small business financing or large-scale overseas business funding, we offer solutions designed to meet your specific needs.

Our loan programs include:

With JP Lending, you get:

At JP Lending Ltd, we provide a full suite of international business funding solutions to help entrepreneurs and businesses grow globally. Our services cover everything from startups to established companies seeking overseas business financing.

We provide industry specific loans for businesses in retail, manufacturing, and agriculture. Our offerings include international business startup loans, international small business loans, and real estate loans, giving companies the funding needed to expand and compete internationally.

Our experts guide businesses on how to get international business loans, assist in preparing applications, and connect clients with international private lenders for business loans. We provide fast approvals, reliable service, and access to comprehensive international business funding solutions.

JP Lending Ltd offers global partnership and joint venture loans to support companies forming strategic alliances abroad. With flexible cross-border financing, businesses can secure overseas business financing from trusted business loan providers experienced in global commercial lending.

We provide research and development funding to help businesses innovate and grow. Our international loans for business support product development, technology upgrades, and operational improvements, ensuring companies have the capital to compete in international markets.

We are more than just international private lenders for business loans. We are trusted partners for business growth. Businesses choose JP Lending Ltd because

We help entrepreneurs across borders access international business loans quickly and easily without unnecessary paperwork. Our process is fast, clear, and simple. We focus on your business potential, not just your location. There are no hidden rules, long waits, or obstacles.

Hundreds of international entrepreneurs have secured cross-border business financing with JP Lending Ltd to grow their companies, hire staff, or manage cash flow. You could be next.

To speed up your loan application for international business financing, please prepare:

These documents help us evaluate your request for international loans for business quickly and fairly.

Applying with JP Lending is simple and secure. Businesses worldwide can obtain international loans for business in just a few steps:

With our streamlined process, businesses no longer wonder how to get international business loans. We make it straightforward and fast.

JP Lending Ltd provides international commercial loans to small and growing businesses worldwide. We help entrepreneurs secure funding no matter where they are located, with fast approvals and flexible terms designed for each market.

Some of the countries we serve include:

Qatar – Supporting startups and SMEs with working capital, expansion, and equipment loans

South Africa – Fast, reliable financing for small businesses and growing companies

USA – International business loans for cross-border ventures and local operations

Dubai– Flexible loan options for startups and established businesses

Kuwait – Financing solutions for entrepreneurs and growing businesses

Hong Kong – Access to working capital and business expansion funding

Saudi Arabia – Loans to support startups, SMEs, and growing companies

Netherlands – Cross-border business loans with competitive terms

Eligibility for our international business financing is simple:

If your business meets these requirements, you’re already on your way to securing international commercial loans with JP Lending.

Hear from business owners worldwide who have benefited from our international business loans:

I’ve worked with JP Lending for my business’s international expansion, and I couldn’t be happier with the experience. The application process was quick and simple, and their team provided support every step of the way. I highly recommend them to anyone looking for a loan!

Liberty Sean

JP Lending helped me secure funding to open my new office overseas, and the experience was flawless. No upfront fees, clear communication, and fast approvals. I felt supported throughout. They truly care about helping businesses succeed

Steve Neibert

I was unsure at first but everything went smooth. Highly recommend for online loans for international entrepreneurs.

Santosh Gavaskar

As a small business owner, finding financing that fits my needs was a challenge until I came across JP Lending Their online business loans are exactly what I needed to grow my business globally. The terms were flexible, and the process was faster than I expected!

krista Keenan

Answers to common questions before applying for international online loans

Yes you can apply from any country without restrictions.

Funds are usually deposited within 24 hours after approval.

No collateral is required to apply with JP Lending Ltd.

You can still apply but funds may be transferred in a way that follows local rules.

Your business must be at least six months old to qualify.

Ready to apply and see how simple getting international online business loans can be?

Key factors to consider when selecting the best cross-border financing option for your small or growing business.

Loan type that fits your business needs

Interest rates and repayment options

Eligibility criteria and required documents

Funding speed and reliability

Transparency and support from your lender

Ready to apply and see how simple getting international online business loans can be?